Civil Rights, Not Ivory Towers: Revoking Harvard's Tax Exemption Is Justified

President Trump is right. Harvard University, with its $50 billion endowment and unaccountable corporate board, functions less like an institution of higher learning and more like a hedge fund with a school as its public-relations arm. Its continued status as a 501(c)(3) public charity is not merely incongruous, it is indefensible. When an elite institution fails to uphold the most basic principles of civil rights, embraces systemic discrimination, and conceals these sins beneath the veil of educational prestige, it forfeits the privileges that come with taxpayer subsidization. The IRS has both the authority and the obligation to revoke Harvard's tax-exempt status. It should do so immediately.

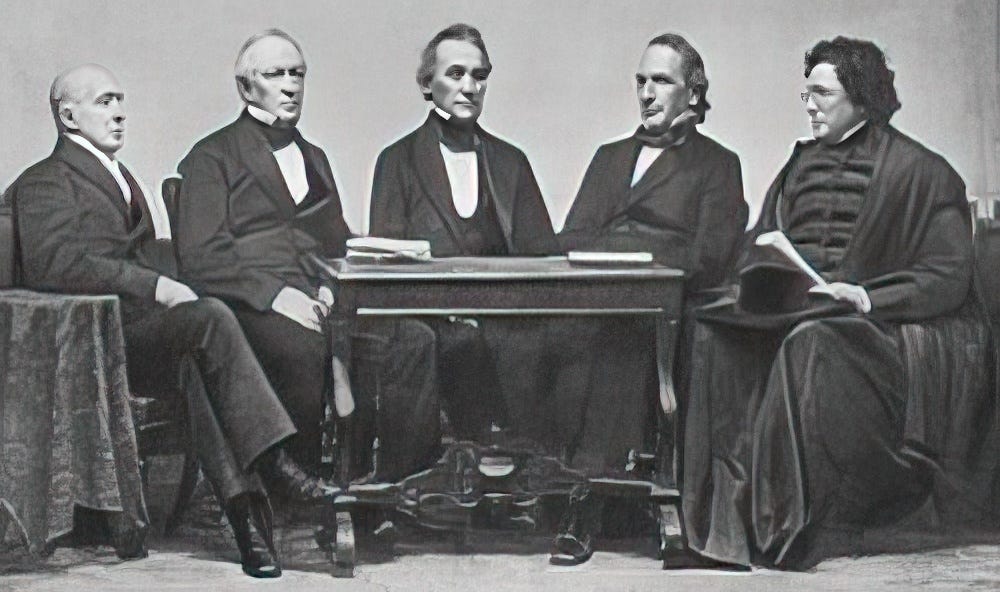

This is not an argument rooted in partisanship. It is rooted in precedent. In 1983, the United States Supreme Court upheld the IRS’s revocation of tax-exempt status from Bob Jones University for its racially discriminatory policies, even though those policies were nominally based on sincerely held beliefs. The principle established was clear: discrimination, even when cloaked in private institutional autonomy, is incompatible with the public interest that justifies tax-exemption. Harvard is not exempt from this standard. It is not above the law, nor above accountability.

Let us examine the facts. Following the October 7, 2023 attacks on Israel, Jewish students at Harvard were subjected to a sustained climate of hostility and intimidation. According to the university’s own task force, many students reported hiding their religious identity. Some feared retaliation for expressing mainstream political views. In a university ostensibly committed to free inquiry, this should be cause for alarm. Instead, the administration’s response was procedural and cosmetic: task forces, listening sessions, and symbolic initiatives. These are not solutions. They are evasions.

And while Jewish students were left to navigate a climate of exclusion, the administration remained preoccupied with its DEI orthodoxy. It is an irony lost on no one that the same institution found to discriminate against Asian-American applicants, in defiance of the Constitution and the Supreme Court, continues to elevate race in its hiring decisions. The recent investigation into the Harvard Law Review's selection practices underscores this contradiction. Merit is subordinated to ideology. Excellence is filtered through a racial lens. This is not inclusion, it is inversion. The colorblind principles that underpin the Civil Rights Act have been displaced by the soft tyranny of bureaucratized equity.

Some will protest: But Harvard is making reforms. That is commendable, perhaps, but irrelevant. Bob Jones University made changes too, years after losing its status. The question is not whether Harvard is improving. The question is whether Harvard, at this moment, qualifies for the extraordinary benefit of tax exemption. The answer is no. The IRS is not in the business of subsidizing civil rights violators in the hope they one day reform. The benefit of exemption is contingent upon ongoing, demonstrable compliance with anti-discrimination norms. Harvard has failed that test.

The size and structure of Harvard’s endowment further undermine any claim to charitable necessity. With assets surpassing the GDP of many nations, the Harvard Corporation generates annual returns in the billions, managed by a team of professional investors whose compensation rivals that of Wall Street executives. These returns fund a vast administrative bureaucracy, including a DEI apparatus larger than the faculties of entire liberal arts colleges. This is not charity. It is an empire.

Moreover, Harvard’s insistence on institutional autonomy, particularly when rebuffing government calls to protect Jewish students or comply with anti-discrimination mandates, cuts directly against the basis for its exemption. If Harvard is private when it comes to oversight, it should be private when it comes to taxation. One cannot accept the privileges of public subsidy while rejecting the responsibilities. To claim otherwise is to endorse a double standard that privileges elite institutions over the constitutional rights of American citizens.

The legal basis for revocation is not speculative. Under Section 501(c)(3), the IRS is empowered to revoke the tax-exempt status of any institution that violates public policy, including civil rights law. As the Supreme Court held in Bob Jones, the government has a "fundamental, overriding interest in eradicating racial discrimination in education" that "substantially outweighs whatever burden denial of tax benefits places on [a university’s] exercise of religious beliefs." If this principle applies to religious doctrine, it surely applies to Harvard's secular dogmas.

It will be said that revoking Harvard’s status risks politicizing the tax code. This is a red herring. The IRS is already politicized, often in favor of progressive causes. It granted exemption to countless left-wing NGOs that engage in advocacy bordering on electioneering. It turned a blind eye to flagrant abuses by activist foundations and university programs that indoctrinate rather than educate. The only novelty in Trump’s proposal is the idea that elite institutions should be held to the same standard as their less pedigreed counterparts.

Harvard’s defenders will invoke academic freedom, as if that sacrosanct principle absolves the university of all other obligations. But academic freedom, properly understood, is not a license for institutional impunity. It is a shield for individual scholars, not a cloak for bureaucratic malpractice. When the institution itself enforces ideological conformity and punishes dissent, it is not defending freedom. It is extinguishing it.

Ultimately, the question is this: Should American taxpayers be compelled to subsidize a multibillion-dollar corporation that discriminates on the basis of race and religion, tolerates hostility toward Jewish students, and flaunts its defiance of public accountability? President Trump has answered no. He is correct. The IRS should act.

Charity is not a birthright. It is a legal designation grounded in public trust. When that trust is broken, the designation must be revoked. Harvard broke the trust. The IRS must now revoke the privilege.

The age of untouchable universities is over. The republic has every right to demand that those who claim its blessings must first honor its principles.

If you don't already please follow @amuse on 𝕏.