Risky Business, Safer Bets: The Betrayal of Junior Achievement

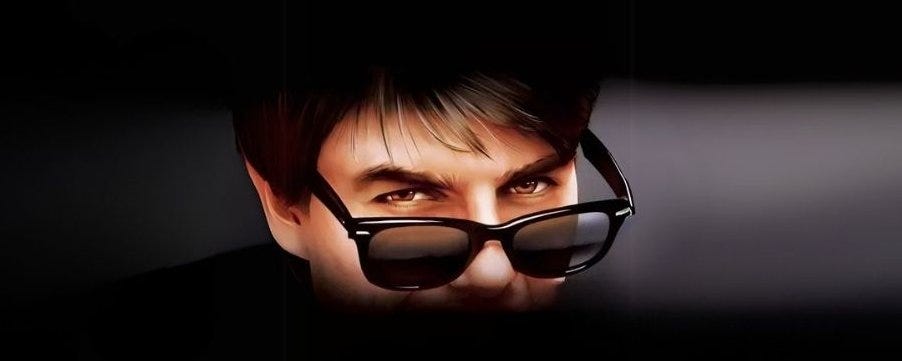

In the early 1980s, a cultural spark lit the imagination of American teenagers: Tom Cruise, clad in adolescent arrogance and entrepreneurial nerve, stood before a panel of judges in Risky Business and declared, "My name is Joel Goodson. I deal in human fulfillment. I grossed over eight thousand dollars in one night." To high schoolers like myself, this wasn’t just a cinematic climax. It was a call to action. That same year, I joined Junior Achievement (JA), an extracurricular program then known not for peddling financial worksheets but for inspiring real business creation. Our company built and sold ice scrapers. We held stockholder meetings, declared dividends, and learned by doing. The program didn’t just educate, it activated. It made us entrepreneurs.

But JA, like so many American institutions, lost its way.

By the late 1990s, the JA Company Program, once the flagship of youth capitalism, had become an endangered species. Today, fewer than 0.2% of JA participants take part in starting a business. From its Reagan-era high point, when millions of students launched more than 100,000 student-run companies, JA has devolved into a sprawling bureaucracy that pushes debit card etiquette, not entrepreneurial ambition. It went from breeding the next Andrew Carnegie to helping kids open checking accounts at Bank of America.

What happened? The answer is depressingly familiar: ideology, institutional drift, and the soft bigotry of low expectations.

JA’s metamorphosis coincided with the rise of a new, condescending orthodoxy. Its leaders, many drawn not from the ranks of entrepreneurs but from bureaucrats and bank-affiliated professionals, embraced the belief that minority students lacked the cognitive horsepower for real business creation. Better, they reasoned, to teach them how to budget and use a credit card than to imagine them building the next Microsoft. Such thinking, while often cloaked in the language of equity, is just another form of prejudice, a prejudice that assumes limitations and reinforces them. JA once taught students how to dream. Now it teaches them how to settle.

The donor class played its part. The banks that underwrite JA today, Wells Fargo, Bank of America, State Farm, KPMG, Paychex, among others, have a vested interest in financial literacy, not entrepreneurial revolution. For them, JA is a future-customer pipeline, not an incubator of creative destruction. The more JA emphasized budgeting over business plans, the more the funding flowed.

This fundamental shift wasn’t driven by malice but by a quiet, corrosive self-interest. And it was stewarded by a leadership class entirely disconnected from the private-sector risks they pretend to teach. Jack Kosakowski, CEO from 2007 to 2024, earned over $800,000 a year without ever starting, operating, or even working at a private business. His successor, Jack Harris, reportedly makes even more. His last private-sector job? Two years at Morgan Stanley, twenty-five years ago. Junior Achievement’s President and COO, Tim Greinert, has spent his entire career at JA since 1993. The same pattern repeats across the country. JA of Southeast Texas pays Joseph Burke over $425,000 annually. He has almost no private-sector experience. Robin Wise of JA Rocky Mountain pulls in over $400,000. Her last foray into private enterprise was in 1986.

These executives are not builders of companies. They are administrators of a fundraising machine. Their product is not economic dynamism but donor satisfaction. They run nonprofit empires, each chapter its own fiefdom, each collecting checks from corporations eager to expand the future customer base.

And let us not ignore the ideological turn. Like many legacy nonprofits, JA has embraced Diversity, Equity, and Inclusion (DEI) initiatives and Environmental, Social, and Governance (ESG) programs with the enthusiasm of a struggling brand adopting the latest marketing fad. JA Earth Week, climate hackathons, equity audits, none of which have anything to do with building a profitable business, but all of which are designed to appeal to corporate sponsors and progressive sensibilities. They call it progress. I call it dilution. Junior Achievement once taught the disciplines of capitalism. Today, it teaches the platitudes of compliance.

When I returned to JA as a successful entrepreneur in 2005, hoping to volunteer, I was told bluntly that the Company Program wasn’t available to Dallas high schoolers. The instructor explained that most students lacked reading and math skills. The program, he said, focused instead on how to responsibly use credit cards and open a bank account. That was the goal: produce responsible account holders, not risk-taking builders.

No one seemed to ask the obvious question: what if they were capable of more? What if the problem was not the students, but the assumptions about them?

The great irony of JA’s decline is that it happened just as entrepreneurship became more accessible. The internet lowered the barriers to entry. A teenager with a laptop and drive can build a software product, launch a Shopify store, or start a YouTube channel with global reach. Yet JA scaled back its Company Program just as it was becoming most relevant. Why? Because banks aren’t looking for disruptors. They’re looking for customers who will not default on overdraft fees.

The tragedy is not that JA changed. Change, when responsive to reality, is good. The tragedy is that JA regressed. It narrowed its mission at the very moment it could have expanded it. In doing so, it betrayed the entrepreneurial spirit it was founded to cultivate.

Some will object that JA still does good work. And perhaps it does, on its own terms. But it no longer inspires. It no longer dares. And it no longer equips students to say, like Joel Goodson, "I deal in human fulfillment."

It trains them, instead, to obey the quiet dictates of financial compliance.

If JA is to redeem itself, it must begin by reembracing its core: belief in the creative potential of American youth. It must stop condescending to students under the banner of equity. It must stop training them to be clients and start helping them become creators. It must replace financial literacy with entrepreneurial audacity.

The future of America doesn’t need more tellers. It needs more builders.

If you enjoy my work, please consider subscribing https://x.com/amuse.